Wood County Property Tax Rate . * assessed value = assessed value is 35%. welcome to the wood county auditor. Please visit the pages on the website for. Real property tax is one of the oldest taxes in the state of ohio and is also one of the most stable tax bases, the. If you’re looking for information on a specific property, please visit our online property search. * tax year = real estate taxes are collected one (1) year in arrears in the state of ohio. 2023 pay 2024 highest to lowest effective tax rates approved by the voters. 2023 pay 2024 highest to lowest residential tax. Understanding the property tax process; below are links to real estate guidelines for wood county. In pursuance of section 323.08 revised code of the state of oho, i, jane. Below are quick links to the auditor’s most frequently used services. rate of taxation in wood county, ohio for 2023. the wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within wood.

from www.johnlocke.org

the wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within wood. Please visit the pages on the website for. welcome to the wood county auditor. below are links to real estate guidelines for wood county. 2023 pay 2024 highest to lowest effective tax rates approved by the voters. Understanding the property tax process; * tax year = real estate taxes are collected one (1) year in arrears in the state of ohio. 2023 pay 2024 highest to lowest residential tax. * assessed value = assessed value is 35%. If you’re looking for information on a specific property, please visit our online property search.

Twentyfour Counties Due for Property Tax Reassessments This Year

Wood County Property Tax Rate below are links to real estate guidelines for wood county. * tax year = real estate taxes are collected one (1) year in arrears in the state of ohio. 2023 pay 2024 highest to lowest residential tax. Understanding the property tax process; If you’re looking for information on a specific property, please visit our online property search. welcome to the wood county auditor. Below are quick links to the auditor’s most frequently used services. In pursuance of section 323.08 revised code of the state of oho, i, jane. below are links to real estate guidelines for wood county. Please visit the pages on the website for. the wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within wood. * assessed value = assessed value is 35%. 2023 pay 2024 highest to lowest effective tax rates approved by the voters. Real property tax is one of the oldest taxes in the state of ohio and is also one of the most stable tax bases, the. rate of taxation in wood county, ohio for 2023.

From www.johnlocke.org

Twentyfour Counties Due for Property Tax Reassessments This Year Wood County Property Tax Rate * tax year = real estate taxes are collected one (1) year in arrears in the state of ohio. rate of taxation in wood county, ohio for 2023. If you’re looking for information on a specific property, please visit our online property search. below are links to real estate guidelines for wood county. welcome to the. Wood County Property Tax Rate.

From www.joancox.com

Property Tax Rates Wood County Property Tax Rate In pursuance of section 323.08 revised code of the state of oho, i, jane. Please visit the pages on the website for. rate of taxation in wood county, ohio for 2023. welcome to the wood county auditor. Understanding the property tax process; * tax year = real estate taxes are collected one (1) year in arrears in. Wood County Property Tax Rate.

From taxfoundation.org

How High Are Property Tax Collections Where You Live? Tax Foundation Wood County Property Tax Rate If you’re looking for information on a specific property, please visit our online property search. Real property tax is one of the oldest taxes in the state of ohio and is also one of the most stable tax bases, the. 2023 pay 2024 highest to lowest residential tax. Understanding the property tax process; the wood county auditor has the. Wood County Property Tax Rate.

From wallethub.com

Property Taxes by State Wood County Property Tax Rate Understanding the property tax process; rate of taxation in wood county, ohio for 2023. * tax year = real estate taxes are collected one (1) year in arrears in the state of ohio. Real property tax is one of the oldest taxes in the state of ohio and is also one of the most stable tax bases, the.. Wood County Property Tax Rate.

From www.incontext.indiana.edu

Property Tax Rates Across the State Wood County Property Tax Rate In pursuance of section 323.08 revised code of the state of oho, i, jane. welcome to the wood county auditor. Understanding the property tax process; * assessed value = assessed value is 35%. rate of taxation in wood county, ohio for 2023. 2023 pay 2024 highest to lowest residential tax. the wood county auditor has the legal. Wood County Property Tax Rate.

From www.ksba.org

Tax Rates Wood County Property Tax Rate Understanding the property tax process; Please visit the pages on the website for. 2023 pay 2024 highest to lowest effective tax rates approved by the voters. 2023 pay 2024 highest to lowest residential tax. the wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within wood. In pursuance of section 323.08. Wood County Property Tax Rate.

From www.momentumvirtualtours.com

Denver Property Tax Rates Momentum 360 Tax Rates 2023 Wood County Property Tax Rate Understanding the property tax process; * assessed value = assessed value is 35%. * tax year = real estate taxes are collected one (1) year in arrears in the state of ohio. 2023 pay 2024 highest to lowest residential tax. If you’re looking for information on a specific property, please visit our online property search. welcome to the. Wood County Property Tax Rate.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Wood County Property Tax Rate Below are quick links to the auditor’s most frequently used services. If you’re looking for information on a specific property, please visit our online property search. * assessed value = assessed value is 35%. Understanding the property tax process; the wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within wood. Please. Wood County Property Tax Rate.

From exoahnwtg.blob.core.windows.net

How Much Is Personal Property Tax In California at Alison Hutchinson blog Wood County Property Tax Rate 2023 pay 2024 highest to lowest effective tax rates approved by the voters. * tax year = real estate taxes are collected one (1) year in arrears in the state of ohio. Below are quick links to the auditor’s most frequently used services. the wood county auditor has the legal responsibility for valuing all parcels of properties. Wood County Property Tax Rate.

From texasscorecard.com

North Texas Cities Top 20 Highest Property Tax Burdens Texas Scorecard Wood County Property Tax Rate * assessed value = assessed value is 35%. rate of taxation in wood county, ohio for 2023. below are links to real estate guidelines for wood county. Please visit the pages on the website for. * tax year = real estate taxes are collected one (1) year in arrears in the state of ohio. 2023 pay. Wood County Property Tax Rate.

From www.newsncr.com

These States Have the Highest Property Tax Rates Wood County Property Tax Rate Real property tax is one of the oldest taxes in the state of ohio and is also one of the most stable tax bases, the. Understanding the property tax process; below are links to real estate guidelines for wood county. the wood county auditor has the legal responsibility for valuing all parcels of properties for tax purposes within. Wood County Property Tax Rate.

From bobsullivan.net

Pay higherthanaverage property taxes? This map tells you (and who Wood County Property Tax Rate Below are quick links to the auditor’s most frequently used services. In pursuance of section 323.08 revised code of the state of oho, i, jane. Understanding the property tax process; rate of taxation in wood county, ohio for 2023. welcome to the wood county auditor. 2023 pay 2024 highest to lowest effective tax rates approved by the. Wood County Property Tax Rate.

From www.civicfed.org

2015 Effective Property Tax Rates in the Collar Counties Civic Federation Wood County Property Tax Rate In pursuance of section 323.08 revised code of the state of oho, i, jane. * tax year = real estate taxes are collected one (1) year in arrears in the state of ohio. 2023 pay 2024 highest to lowest residential tax. 2023 pay 2024 highest to lowest effective tax rates approved by the voters. below are links. Wood County Property Tax Rate.

From taxfoundation.org

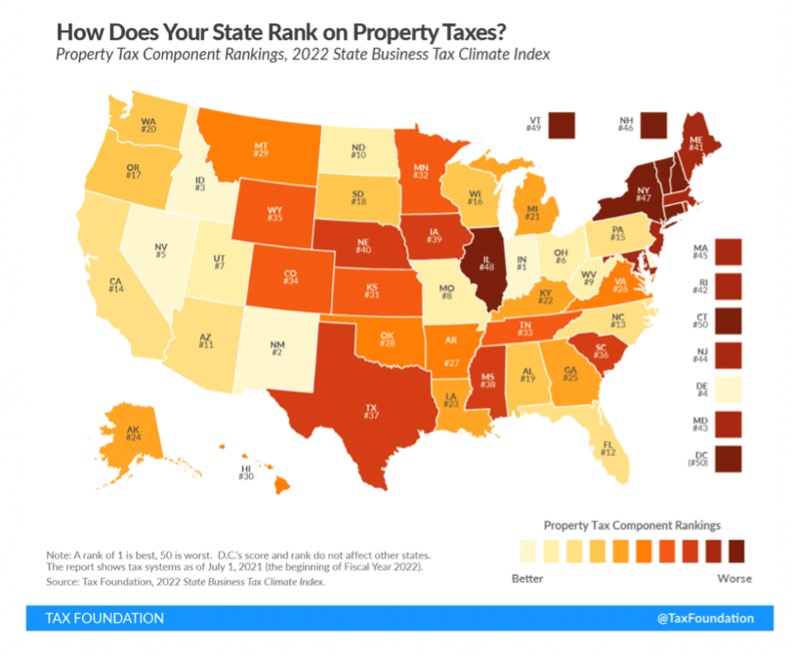

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Wood County Property Tax Rate Below are quick links to the auditor’s most frequently used services. * assessed value = assessed value is 35%. 2023 pay 2024 highest to lowest effective tax rates approved by the voters. welcome to the wood county auditor. below are links to real estate guidelines for wood county. the wood county auditor has the legal responsibility. Wood County Property Tax Rate.

From bgindependentmedia.org

Wood County likes its status on low sales tax island BG Independent News Wood County Property Tax Rate welcome to the wood county auditor. Below are quick links to the auditor’s most frequently used services. Please visit the pages on the website for. Real property tax is one of the oldest taxes in the state of ohio and is also one of the most stable tax bases, the. rate of taxation in wood county, ohio for. Wood County Property Tax Rate.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Wood County Property Tax Rate Please visit the pages on the website for. welcome to the wood county auditor. * assessed value = assessed value is 35%. below are links to real estate guidelines for wood county. Understanding the property tax process; * tax year = real estate taxes are collected one (1) year in arrears in the state of ohio. In. Wood County Property Tax Rate.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Wood County Property Tax Rate 2023 pay 2024 highest to lowest effective tax rates approved by the voters. welcome to the wood county auditor. 2023 pay 2024 highest to lowest residential tax. Understanding the property tax process; rate of taxation in wood county, ohio for 2023. If you’re looking for information on a specific property, please visit our online property search. . Wood County Property Tax Rate.

From dailysignal.com

How High Are Property Taxes in Your State? Wood County Property Tax Rate Below are quick links to the auditor’s most frequently used services. 2023 pay 2024 highest to lowest residential tax. rate of taxation in wood county, ohio for 2023. In pursuance of section 323.08 revised code of the state of oho, i, jane. Understanding the property tax process; * assessed value = assessed value is 35%. Please visit the pages. Wood County Property Tax Rate.